Investment philosophy

Exponential growth

exponentia ventures has a long-term view on its investments to build successful businesses and enhance shareholder value.

The overarching philosophy is to take substantial equity in select business ideas where we can add strategic value that enables us to actively contribute in two core areas: growth strategy & its execution and corporate governance.

VIEW MORE

VIEW MORE

portfolio

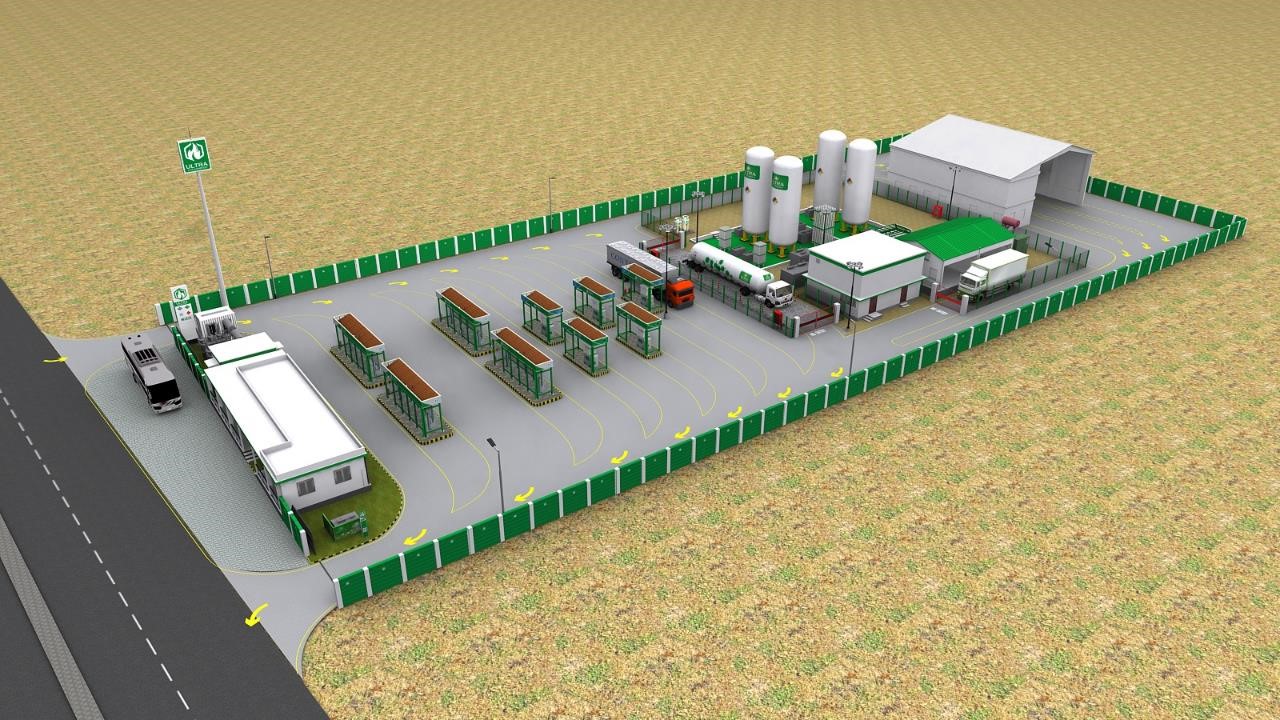

Ultra Gas & Energy Limited

Ultra Gas & Energy is a clean energy company committed to the global ESG agenda, it is building one of India’s largest & most extensive network that will provide all forms of clean energy for automotive & in time to come for industrial customers: LNG, Electric, other Natural Gases, & hydrogen in the near future.

portfolio

Blue Energy Motors

Blue Energy aims to be ‘Zero’ emission transport system leader, addressing end-to-end commercial vehicle eco-system and facilitating mass adoption of green and clean fuels in logistics, it aims to build scale through asset light micro manufacturing globally.

portfolio

pluckk

pluckk is a lifestyle-focused fresh produce brand that caters to the modern & digital savvy Indian consumer looking to enrich their lives by eating good every day. pluckk promotes ethical and sustainable growing practices to ensure the entire ecosystem is able to thrive from farm to plate. #EatGoodDoGreat!

portfolio

GreenLine

GreenLine is pioneering green & smart logistics in India.

As India’s first green & smart logistics co. GreenLine is partnering conscious corporates to reduce its carbon footprint. GreenLine promise of 100%Captive – 100% Green – 2X Faster – 5X Smarter allows them to deliver green logistics at no extra cost vs. traditional fossil fuel logistics.

team

The exponentials

Anshuman Ruia

Advisor

Global Investor in new age businesses. Known for his foresight, financial expertise and project execution skills. A passionate investor who believes in sustainable growth.

Alok Gupta

Partner

Entrepreneurial leader with cross sector experience, leveraging technology solutions and building high performance teams to solve complex business problems is what he loves most.

Vikash Saraf

Advisor

Acquiring assets & managing growth in the corporate finance sector. Monitoring performance of operating companies & empowering a spectrum of roles in strategy, mergers & acquisitions.

contact

Let’s start a conversation

We look forward to hearing from you